Set your Trading System Goals First

(then design everything to deliver them)

|

Your trading system goals impact everything you do in trading system development and your ultimate profitability. Most traders fail because they try to use someone else's system, take tips, read trading newsletters or rely on broker recommendations. These methods are all flawed because they do not take into account YOUR trading goals. Your goals are as unique as you are! More than most disciplines you will need to be 100% clear on your objectives to be successful in this trading. Without clear goals, you will not succeed in trading - PERIOD! Writing my specific trading goals gave me dramatic and unexpected benefits which I will tell you about below... |

Setting written goals puts

you at a significant advantage over other traders

What should trading system Goals include?

Trading system goals should consist of a precise written statement about each of the following:

- Your ideal lifestyle (that you want your trading to support)

- Amount of time you will spend on your trading each day

- Annual percentage return

- Maximum drawdown

- Maximum monthly drawdown

- Maximum length of drawdown

- Worst case drawdown

If you don't have these objectives clear, it is impossible to know when your trading system is sufficient. You will also not know if your trading results are meeting your objectives once you actually start trading.

This sounds like a minor point, however, trading through a drawdown of 15-20% will be very difficult if you have not already established your maximum drawdown tolerance and designed your rules to support and deliver on this objective. On the contrary, if your trading system goals are to avoid drawdowns of 40% or more, then a 15-20% drawdown will not be an issue for you.

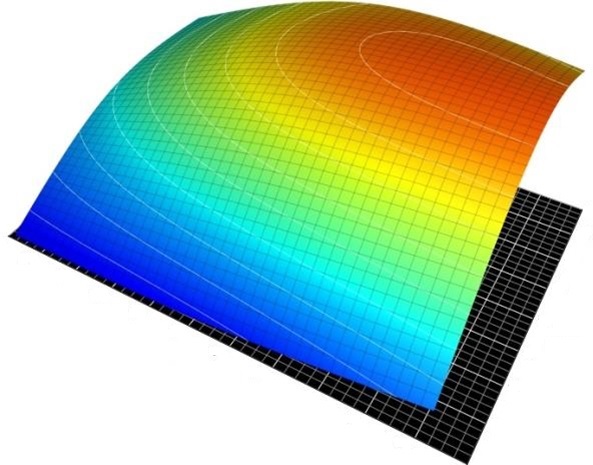

Knowing how much to risk on each trade is impossible if you have not established your profit objective and your drawdown tolerance. Surprising as it may seem, changing the amount you risk per trade by only 0.25-0.5% can make a dramatic difference to the shape of your equity curve, your rate of return and the size of your maximum drawdown.

Without written trading system goals it is impossible to

determine how much to risk to take on each trade

How my Written Goals helped me

My personal experience on this was a real eye opener for me. Before writing my trading system goals I spent countless hours tinkering and 'optimizing' and tweaking trading systems.

With no clear outcome to work towards, so there was no way of knowing when to stop, nor what was being optimized for. It was difficult to gain confidence in new systems and progress on diversification became very slow.

Once I documented my goals for my overall trading program and for each new trading system, the trading system development progress accelerated, objective functions became clear and the system parameters fell into place much more easily. I also ended up building much more profitable trading systems with smoother equity curves!

If you haven't already done it, write down your trading system goals in as much specifics as you can. Do this before continuing on with your system development.

Establish your reason to succeed: YOUr ideal life

Trading system goals are just one aspect of setting objectives and goals for your life. It is important to have your trading goals written and clear, but if you have no idea how these fit into the rest of your life then you will likely struggle to find the motivation and discipline to succeed in your trading business.

Jim Rohn said that if your ‘WHY’ is big enough then the ‘HOW’ doesn’t matter. What this means is that when your reasons for succeeding are big enough, nothing can stand in your way – you will find a way to succeed no matter what.

Developing a profitable trading business is difficult, but if you have a big enough reason to succeed then you will.

Once you succeed in the trading systems

business the rewards are immense!

An exercise that I have been through a couple of times in different forms and have found extremely helpful in establishing a ‘big why’ is to define what your ultimate life will look like in as much detail as possible.

The intent of the exercise is to capture all the things you want to do with your life once time and money are no longer a problem for you – once you are free. Whether you call this your dream board, your dreams list, your dream life or your ultimate lifestyle doesn’t matter, the intent is the same:

Create a picture of your ideal life in as much

detail as possible to move you to take action and succeed

This can be done in one of three ways depending on your preference:

- Assemble a dream board that has pictures of everything you want in your life

- Create a dreams list of ~100 things you want to do with your life

- Write a document that describes in rich detail what your future life looks like

Take 30 minutes NOW to create first draft of your ideal life

Identifying the dream is the first step to achieving it!

The trick with this exercise is to not hold back or limit yourself to what is ‘reasonable’ based on your past experience. Remember you are trying to create a compelling future to drive you to the action required for you to become a successful systems trader.

In Van Tharp’s fantastic workshop ‘Blueprint for trading success’ one of the exercises he takes you through covers exactly this – They call it your ‘Dream Life’. The workshop helps you establish compelling reasons to succeed and puts you on a firm footing for trading success regardless of your trading style.

'Blueprint for trading success' then goes far beyond this to help you understand yourself as a trader and formulate your own unique approach to trading with a solid understanding of the key principles of success in this business. Van Tharp is a world renown trading coach and is one of the few trading workshops educators that we recommend – Learn more about 'Blueprint for trading success' and other Van Tharp workshops.

Incorporate your Goals into your trading plan:

My trading plan discussion explains the rational and value in documenting all elements of your trading business. The beginning of your trading plan should establish your reasons to succeed, to give you the drive to follow the rest of your plan.

Now that you have created a first draft of your ideal life (you have done this right?) I recommend you include this in your trading plan so that you always remind yourself of your reasons when reviewing your trading plan (which should happen often).

If you don’t have a trading plan yet then we recommend you start one as a first priority – your ideal life is the first step in your trading plan! If you are not sure how to start your trading plan – read how here.

Warning: Your objectives may not be conscious

All behaviour is driven by our objectives. The difficulty most people have is that the objectives that drive them are not conscious. If objectives are not conscious then we are not really aware of what we are working towards or why we do the things we do.

If you have no written trading system goals then you are in extreme danger with your trading because you are being driven by subconscious objectives. These are very unlikely to support good, profitable trading. Read a range of trading psychology books and you will see that these subconscious objectives are likely to be something like:

- Desire to be right

- Desire for excitement

- Social acceptance

- Avoidance of pain and discomfort

Each of these subconscious objectives can sabotage your trading:

- Desire to be right: Causes you to cut winners early and hold onto losses in the hope that they will turn around. This reduces the size of your average winning trade and increases the size of your average losing trade.

- Desire for excitement: Causes you to over trade (trade too frequently), and take poor trades just to give you some action. The desire for excitement may also cause you to excessively monitor your trades, wasting time, increasing stress and increasing the risk of mistakes.

- Social acceptance: Causes you to discuss your positions / holdings or performance openly, leading to attachment to positions, stress about your performance and the giving / taking of tips or advice which can undermine the integrity of your trading system.

- Avoidance of pain and discomfort: Causes you to not take actions that may lead to pain such as taking a loss. If you are unwilling to incur a small pain now, the situation could deteriorate and become a much larger pain in future. Causes you to cut winners early and hold onto losses in the hope that they will turn around. This reduces the size of your average winning trade and increases the size of your average losing trade.

Trading system goals need to be written down and revisited regularly to keep you focused on what you are trying to achieve with your trading system as you go through the trading system development process.

Return to top of Trading System Goals.

Main Trading System Goals Page: Set your Trading System Goals First (then design everything to deliver them)