Trend Following System Components

A trend following system is a relatively straight forward approach to system trading which can be readily developed and managed by people with a full time job or those who do not have the time or inclination to sit in front of the computer trading for more than 30-60 minutes a day (like me!!).

As discussed in the Trend Trading strategy page, this is a great way to profit from large moves without having to manage positions on an intraday basis. Realistically most people with a full time job are not able to focus on managing their trades every day, so a trend trading system which involves a small amount of maintenance once each day may be just what you need.

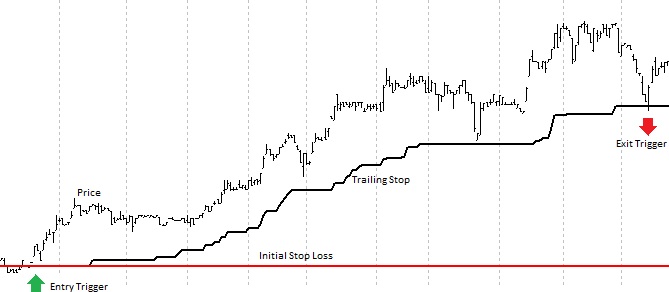

The following sections describe the trend following system approach to each of the system components illustrated in the picture below: setup, entry trigger, initial stop and exit rules.

Of course there is an infinite array of potential eod trading signals that you could use for any trading strategy, so here we describe conceptually what you should be trying to achieve. You are free to select trading signals that suit your beliefs and objectives and also fit with the style of trading system that you are trying to develop.

Setup:

The setup sets the conditions under which we will consider taking a trade. If the setup is not in place then all entry triggers are ignored. The setup ensures the environment is right for your trading system to have a high probability of working.

In a trend following system your setup will primarily be focused on identifying that a strong trend is in place and that the trend is sufficiently stable to consider participating. It may be that the instrument is trending, but if it is either too volatile or not strong enough there may not be sufficient profit potential in the trade to justify taking the risk.

At the most basic level, an instrument can be considered to be trending if it has moved by more than some minimum threshold within a certain timeframe. The simplest setup might be something like the price is above the 200 day moving average, however this tends to be a bit blunt and let in some instruments that are not really moving.

The 200 day moving average is one of the

most powerful signals in technical analysis

An addition to the 200 day moving average may be to measure the speed of the trend by setting some minimum threshold by which the price must move such as a multiple of the Average True Range.

Trend following systems may also consider the external market state as part of the setup before taking a trade. For example, some trend following systems only take a trade in the direction of the broader market trend. If you had this rule in your trading system and the major stock market index was trending up then you might only take long trades and ignore short trades.

Entry trigger / buy signal:

Once your setup is in place, the entry trigger is the rule that determines the exact timing for when you want to enter the trade. Your objective for an entry trigger is to identify a low risk entry point.

A low risk entry point is a point at which you believe the trend has a higher than normal chance of continuing and where our initial stop has a lower than normal chance of getting hit.

Everyone will have slightly different beliefs about what actually constitutes a low risk entry point. Here are some example beliefs that you may want to test:

A low risk entry point occurs when…

- …there is a pullback followed by a resumption in the trend

- …there is a narrow range day (or days) followed by a volatility breakout

- …there is a volatility breakout in the direction of the trend

- …the previous X day high is exceeded

- …insert your own belief here

Note that these are not necessarily factual statements! In fact, I may not even believe that some of the above are true – they are just food for thought to stimulate you.

Everything about trading system design is based on your beliefs

You need to determine your own beliefs and test them with the right backtesting software during your trading system development process

Initial stop loss:

The initial stop loss is an extremely important component in the design of a trend trading / trend following system.

A tight initial stop will give a high percentage of losing trades, but your winning trades will return many times your average risk (high R Multiples). A wide initial stop will give you more winning trades but your winners will be smaller multiples of the amount you risked on each trade.

Given we usually apply a trend following system to a wide range of instruments, and these instruments all have different volatilities and behavioural characteristics, we prefer to use initial stops which adjust for the volatility in each of the instruments rather than a fixed percentage stop.

For example, your initial stop might be somewhere between 1.5 and 5 average true ranges below your entry price depending on what performance profile you are trying to achieve. A value anywhere in this range will most likely work, but you will need to be aware of the psychological impact of using a stop as tight as 1.5 ATRs given this will likely give you in the order of 80% losing trades depending on how good your entry trigger is.

Like every component of your trend trading system, the initial stop is based on your beliefs about the way the markets move. Many beliefs may be relevant, but here are a couple of ideas to stimulate your thinking (note these are phrased assuming a long only system):

A trade is likely to be wrong and I should exit if…

- …the price drops by X ATR below my entry price

- …the price falls below the lowest price of the last X days

- …the price falls below yesterday’s low price

- …the price drops below a key support level

- …the price drops below the X day moving average

- …add your own beliefs here

Again, these are not statements of fact, they are example beliefs that are meant to stimulate your thinking. You need to determine your own beliefs and test them with the right backtesting software to determine if your beliefs are valid.

Exit rule:

In trend following systems, the exit rule is based on some measure of whether the trend has ended. There are many ways to measure when you believe the trend has ended or the risk of remaining in the trend is no longer warranted.

This is where your preferred timeframe becomes extremely important. For example, if you are happy to trade the primary multi-year trend, you are likely to have a much looser exit rule than if you trade the 1-3 month trend.

Some common methods of identifying the end of the trend include using…

- …a trailing volatility stop (eg. if price falls 4 ATR from the highest high you exit)

- …a trailing percentage stop (eg, if price falls 25% from the highest high you exit)

- …the price crossing below some moving average (eg. if price crosses below the 100 day moving average you should exit)

- …add your beliefs and ideas here

There are many other exit rules you may consider, but if you are after a PURE trend trading / trend following system then this style of exit is what is required.

Money management and position size rules:

Money management and position size rules are used to determine everything else about how you manage the portfolio of trades generated by your trading system. This includes questions such as:

- How much you should risk on each trade

- How many signals you will take in a particular instrument

- How many trades you will have open at any one point

- How much total exposure and leverage you take on

- How much exposure to related instruments you will have as a maximum

- How much long vs short exposure you should have

- What total open trade risk you are willing to accept

Answering these questions is virtually impossible without understanding how a portfolio of multiple simultaneous trades behaves. This is because your risk profile changes every day – every time the price moves on any of your trades, every time you enter a new trade, move a trailing stop level or close an old position. This can only be understood by using a portfolio level backtesting and simulation package combined with historical data for your chosen instruments.

Portfolio level simulation of your trading system

using good backtesting software is absolutely critical

Once you have designed your system setup, entry, initial stop and exit rules, there is a significant amount of work then required on the money management and position size rules to ensure your system meets your objectives.

The primary consideration here should be to ensuring you remain in the game – because after all:

You can’t win the trading game if you are not in the game

(Capital preservation is critical to success)

So you must ensure that you risk a sufficiently small percentage of your account on each trade because (particularly in a trend following system) you will have a high percentage of losing trades. If you risk too much on each trade a long losing streak could wipe you out.

I strongly suggest you start with a small level, in the order of 0.5% or less, of your total account at risk on any one trade. You should also limit your exposure to a level in which you will not get killed by your largest expected drawdown - maybe just take on no leverage and test the impact of leverage as you learn and grow as a trader.

Note that this still does not guarantee survival, nothing can – it is all just about controlling risk as much as possible and improving our chances.

Each of the other money management rules listed above can be tested thoroughly in a good portfolio level backtesting package as part of your trading system development process.

Trend following system Conclusion:

Each of the five components of a trend following system should be developed based on your own beliefs about the markets and based on your own objectives. Everything about trading system development is a tradeoff and there are no absolute ‘right answers’.

In our discussion on trading system development we will explain how to pull together the setup, entry trigger, initial stop, exit and money management / position size rules in a way that help you meet your objectives.

All parts of a trading system are connected – it is insufficient to

understand each rule, you must understand how the rules interact

If you do not yet have your trend trading software for portfolio level backtesting and the market data to test your system on your chosen markets then this is now an important step. You cannot effectively undertake trading system development without these tools.

I use Tradesim and TradingBlox for these activities.

Click the button below if you want a free consultation to learn more about trend following in stocks:

Related Articles:

- Main Trading Strategy Page: Does your stock trading strategy REALLY suit you?

- Best Trading Strategy – Self Assessment Questionnaire

- Trend Trading / Trend following - What is it and how does it work?

- Trend Following Stocks is a great trading strategy

- Swing Trading - What is it and how does it work?

- Mean reversion to diversify your trading program

Return to top of Trend Following System.

Return to Home Page

Looking for something else - Find it on the Sitemap